The problem you may currently be facing is that you know you need to change your pricing strategy to keep up with inflation and demanding manufacturing costs, but you can’t decide how best to do this. And you need to come up with a plan, fast.

The way we see it, there are two main pricing options to deal with inflation: shrinkflation (decreasing the amount of product while the price stays the same) or price increase. But which one is the right option for you? As you know, this is a very big decision as it could have large implications for your customer base and brand reputation. The question is whether your customers would rather pay the same amount for less product or pay more for the same amount of product?

Let's begin by explaining each strategy in a bit more depth.

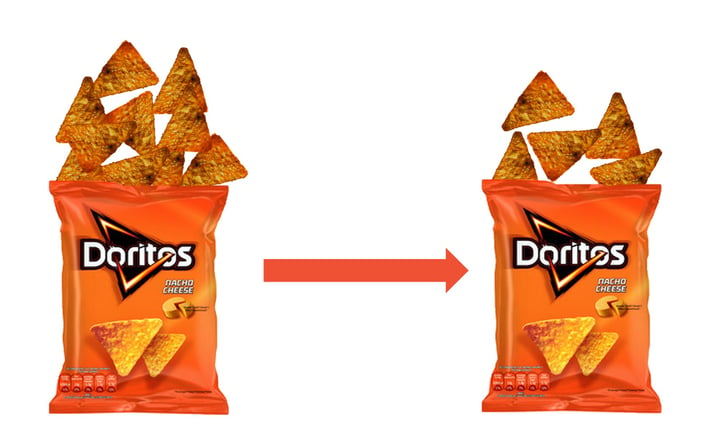

Shrinkflation

Firstly, shrinkflation: the amount of product in the packaging decreases, but the price stays the same. It’s been a very popular choice recently for companies trying to combat inflation. For example, Doritos has cut the size of their bag, there are now 5 fewer Doritos per bag, but the price is still the same. A good strategy for dieting perhaps but was this the best pricing strategy they could take?

Research by Yao et al. can attest to shrinkflation. Their study showed that due to a cognitive bias that consumers have, shrinkflation was actually preferable to price increase. This is an unconscious bias whereby the consumer focusses on price regardless of the situation. In other words, the price has a greater influence on the desire to purchase something as compared to the size of the packaging, for example. There’s a reason many companies have opted for shrinkflation.

However, there’s one major reason holding some companies back from shrinkflation. When employing shrinkflation, the consumers aren’t made aware of the change, and this could be seen as dishonest. So, is shrinkflation the best option available to you? Before you decide, let’s explore the other option: increasing the price.

Price increase

This solution may be worrying to some marketers, as consumers will likely realise that the price has increased. This could make them inclined to purchase a cheaper alternative from another brand. On the other hand, this does solve the ethical dilemma of dishonesty presented by shrinkflation.

To make price increase a little easier, Utpal Dholakia (researcher and marketing professor) provides some important advice. First of all, let the consumer know exactly how the price will change: inform them by how much, why and when this will occur. Secondly, keep it simple and to the point, don’t use terms the consumer won’t understand. If these steps are followed, although the consumer won’t be ecstatic about the change in price, they’ll probably accept the change.

Increase the price in small increments

One way to increase prices is to use a psychological principle known as the “just noticeable difference”. This is definitely not our preferred strategy as it misleads the consumer. This is a principle regarding the smallest possible change that people will notice. Rather than infrequently increasing prices by a considerable amount, you can frequently raise prices by a lower amount which is less noticeable. However, this isn’t the most effective way of increasing price because although these small differences may go unnoticed initially, consumers will eventually realise that there has been a price increase. They’ll feel misled which could damage your brand’s reputation.

So, what’s the verdict? Shrinkflation or price increase? Sadly, there isn’t one clear answer for all cases as they’re very different approaches. With price increase, we rely on openness and honesty and expect to take a hit, and with shrinkflation we’re hoping to coast by without raising suspicion.

Rather than trying out both and seeing which works better, there’s a way that you can measure the willingness to pay a certain price using the consumer’s brain and discover the optimal strategy for you.

Measuring the price in the brain

For instance, it may seem challenging to decide on the right price increase without losing too many customers. And using trial and error isn’t the most efficient way. Luckily, there is a solution that provides greater certainty. With the help of NeuroPricing™, the quick, automatic and intuitive responses to prices are measured.

The decision to buy a product is often an unconscious process. Upon seeing the product (and its contents) with its price, the brain automatically calculates whether this price is reasonable. These automatic calculations determine the consumer’s ensuing behaviour: whether or not your product or service will be purchased.

With NeuroPricing™ you can discover the exact optimal price, down to the nearest cent, for your product. Our research may surprise you as a price increase for an existing product may seem impossible, but we have found that often it’s a viable option.

We can also measure whether a change in the contents of your product will influence the willingness to pay. In this way, you can find out which price strategy will work best for your product or service during times of inflation.

You can read more about NeuroPricing here. Contact us to find out more!