"We believe future pricing questions should be answered using NeuroPricing® because the results are significantly more accurate than those of alternative research methods." Vildan Ekmen, Revenue Strategy Manager PepsiCo Frito-Lay, Turkey

Does a price increase lead to a decrease in revenue?

Research question PepsiCo:

- What's the impact of a 0.25 Turkish Lira price increase on the sales of Lays chips?

- Which research method best predicts sales: traditional questionnaires or NeuroPricing™?

How it's studied

Two methods were used to investigate this: traditional questionnaires and neuro-research. We wanted to know which of the two methods best predicted sales outcome. Crucially, we wanted to know:

Does what people say or measurements of their brain experience better predict sales outcome?

Traditional questionnaires

Before the NeuroPricing™ study, test participants were asked via questionnaires to give their opinion on the price increase of 0.25 Turkish Lira for a bag of Lays crisps. The questionnaire measured the likelihood they would buy a bag of crisps after the price increase. After the questionnaire, the same participants were measured by using EEG-research (NeuroPricing™).

EEG-research

The choices we make are mostly automatic and unconscious. This means that most consumers make purchasing choices unconsciously, though many of them will proclaim they were making 'conscious' choices. If you ask people to consciously think of a price increase, they will probably respond negatively. After all, who wants to pay more? To know whether a price increase of 0.25 Turkish Lira leads to a revenue loss, we need to measure the unconscious brain processes. NeuroPricing™ does this by capturing the automatic, unconscious brain responses with EEG (check NeuroPricing™ here)

Participants were randomly presented with Lays packages, each with a different price. For each price, participants had to indicate whether they thought it was 'expensive' or 'cheap'. At the same time, their brain activity was measured using EEG. EEG measures the activity of the neurons (brain cells) via electrical signals on the brain surface.

At Neurensics, we know the brain regions which indicate the optimal price, also known as the feel-good price. We have been able to determine the exact brain regions by validating 8 years of EEG research with fMRI scans. This enables us to predict the optimal price based on unconscious brain processes, where consumers choices are made.

Results

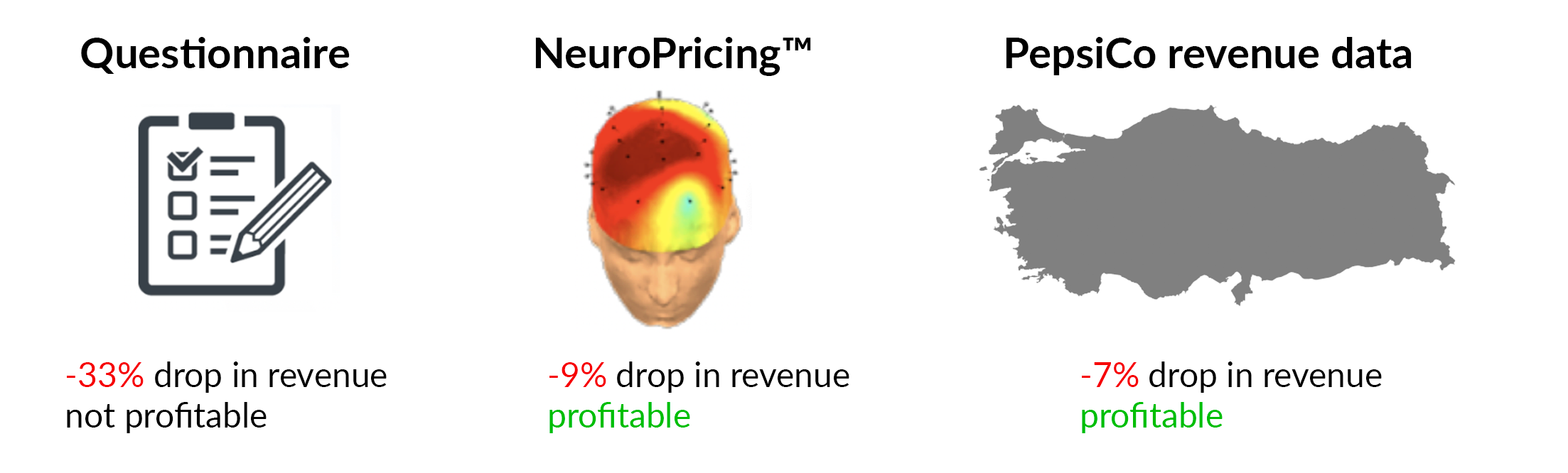

The NeuroPricing™ results were strikingly different to results from traditional questionnaire:

- Traditional questionnaire predicted: a 33% drop in sales and not profitable.

- NeuroPricing™ research predicted that the price increase of 0.25 Turkish Lira leads to a 9% drop in sales but is profitable.

- After the price increase, PepsiCo shared the actual sales figures with us. It turned out that it was only 7% less than the previous year and was indeed profitable.

- This confirms that asking people what they think of a price increase does not lead to accurate results. On the other hand, measuring unconscious brain responses does bring better predictions.

Advice to Lays

The price increase of 0.25 Turkish Lira leads to a 9% decrease in revenue, but is profitable. The price increase is therefore a good option.